For many Indians studying from leading global Universities is a distant dream. We need to ensure we build our profile towards the University requirements and ensure we crack the exams like GRE /GMAT/SAT and ensure our GPA is excellent. Once we are admitted to our dream university we then hit the roadblock to finance the Study abroad. The cost to study in these countries varies as per universities, courses, duration, and the cost of living. We at Edu-loans understand the complexities of attaining education loan for study abroad and therefore we have customized all the overseas education loan online solutions for each county to help and motivate brilliant minds to pursue higher studies in some of the most elite and international environments of the world.

Our customized solutions based on Eligibility, Cost and Convenience for education loan in India and abroad study have made us the most preferred platform to cater to the financial needs of students studying various different courses, in over 1000+ different Institutes, across more than 30 countries. We have over 8000+ students on our platform and we cater to over 1000 students year on year. We make sure that we provide a plethora of education loans for study abroad options within your reach across multiple countries and courses. Our data analytics analyze past trends which rate each financial provider in the parameters of Speed, Clarity and Accuracy. We ensure that you are provided the best hassle service in town to get the most economical education loan for Study Abroad.

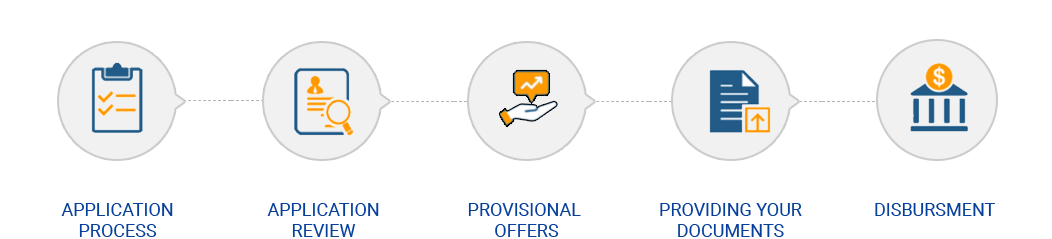

IN order to facilitate faster turnaround, we are the first and the only digital platform to build API integration facilities with major banks of India. We provide overseas education loan online wherein we have the applicant completely fill in the entire data and upload the basic set of KYC documents. The overseas education loan online platform is comprehensive using the correct machine learning algorithms to help you ascertain your exact requirements. We are looking to make the entire overseas education loan platform Online and hassle free for the student wherein he would be requiring to fill the basic forms and we would be able to pull out his and his co signors history through PAN card databases. We have managed to reduce the operating time by over 40% for our students. We have managed to get a partial or complete integration with the financial providers wherein we are able to get the loan application logged into the system of major nationalized banks and look to perform the entire process online.

So, fly over your dreams with our easy process for overseas education loan online and adore your goals. We try our best to process your loan applications with utmost importance though our dedicated loan specialist for studies abroad solutions that are designed with industry expertise and extensive research data to assist you through the competitive platform of higher education. Our education loan for study abroad helps you get the key to your dreamland. We have dedicated loan guidance counsellors who not only help you ascertain your eligibility but also help you coordinate with the various banks and financial institutions.

Eduloans aims to provide education loan for study abroad that are tailored around your needs. We also provide solutions to all the hindrances that may come your way as you chase your higher education dreams. We understand the complexities of your educational loan process and therefore we try to hold your hands right from pre-admission loans for proof of funds and pre-visa disbursement loans to visa formalities, keeping in mind the right way to expedite your admission process.

We ensure that you can simply avail education loan for study abroad with our easy process which is sensitive to your needs and requirements. Eduloans help you pass through all the fine print and complex procedures easily to provide you with a swift, positive, and constructive educational loan experience. So simply sign up and start your student loan search today.